Dear Valued Client,

“With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” — Carlos Slim Helú

Aloni Goh Wealth Strategy Notes:

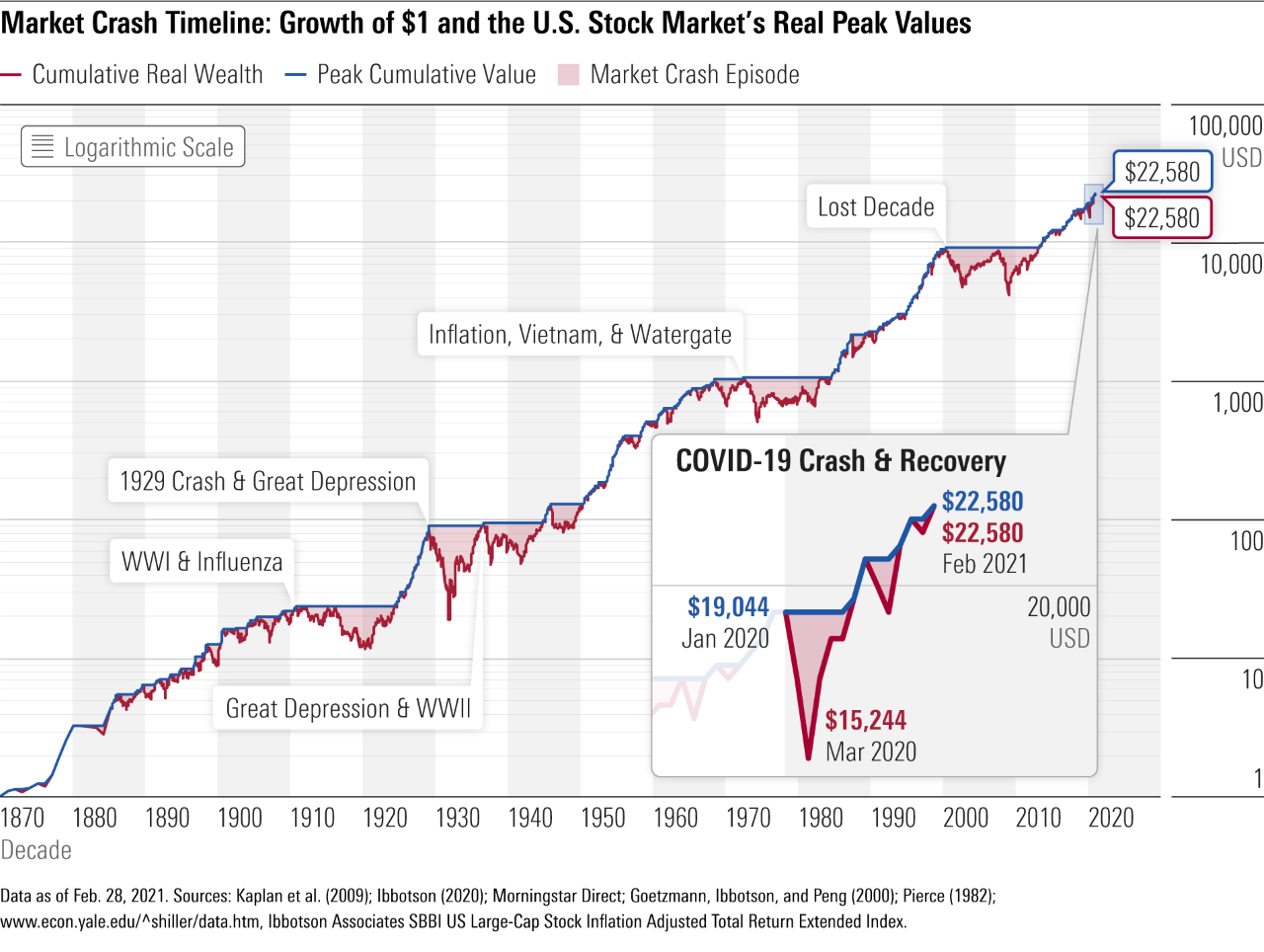

Equities were grinding to record-high levels for most of November until news of the omicron COVID variant triggered heavy selling. At this point, the markets are jittery and there will likely be some sharp moves in both directions as news on omicron develops. Our view is that this will not damage the markets significantly on a long-term basis, and we are maintaining our equity allocations for now.

As always, our advice during times like this is: do not panic, take a step back and look at the big picture. The big picture is we have had extraordinary gains so far this year and this pullback, even if it gets worse, has and will only make a small dent on our gains. The big picture is that the world has learnt how to deal with pandemics quite well, as far as protecting the economy and the financial markets go, and we expect that even if things get worse on the pandemic front, the economy will adapt and the markets will continue their long-term uptrend after this pause. The big picture is that we are investing for the long term, and if you look back, downdrafts like this always seem very severe when we are in the midst of it, but when it is over, it always looks like an opportunity to allocate more funds into your investment portfolios.

Extra Reading:

Forbes.com published an article in March this year, coinciding with the one-year anniversary of COVID lockdowns. In their research, they made key conclusions that align with the long-term investment theses of Aloni Goh Wealth Management. Chief among them is to buy and hold, to not panic and to invest now rather than waiting for the dust to settle.

On buying and holding:

“The Covid-19 crisis was the ultimate affirmation of… the golden rule of investing, buy and hold. Your aim as an investor should be to find high-quality companies and hold onto them for as long as possible… If you had sold at the bottom of the recent bear market, you’d have been cashing out at 2016 S&P 500 levels and then have been faced with the difficult task of determining when to reenter the market… If you’d stayed steady, though, you’d have effortlessly benefited from all of the return.”

On not panicking:

“‘The initial result is that most were paralyzed and sold investments incorrectly, and then went into cash and stayed paralyzed,’ [Paul Miller, CPA] says. Those who did that, of course, ended up locking in losses and missed out on a lot of that nearly 100% gain since last March.”

On investing now:

“With all the noise of market volatility, it can be tempting to try to wait out for a ‘best’ time when the market has steadied and is on a consistent upward trajectory… While the big example of that is obviously the almost doubling of an investment that took place from March 2020 to March 2021, almost each month you delayed starting investing would have cost you in the past 12 months.”

Morningstar’s study on holding investments through crashes and crises:

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.