Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

Equity markets are undergoing a rocky start to 2022. This is not unexpected as there were previews of volatility toward the end of 2021, mostly caused by the continuing crash in speculative high growth sectors. It was inevitable that the stable sectors still in an uptrend, such as Financials, would start to undergo some kind of pullback.

We view this as a very healthy correction and one which is much needed in order for the secular bull trend to continue. Hence, we are not perturbed and will ride out this correction without many adjustments to our portfolios. We are able to be in this stress-free state because we have very little exposure to high-growth stocks and we have made very comfortable gains in most of our positions in large cap, secular growth stocks. We can only imagine the despair that those market players must be going through, chasing high growth and based their investment decisions on what they read on Reddit and watched on YouTube.

Extra Reading:

The Wall St. Journal recently caught up with six investors who participated in the meme stock craze and the results are, unsurprisingly, a reality check. Retail investor Joanna Burns, for example, disclosed that she entered AMC at around $13/share, adding more as it moved up and down. AMC is currently trading at $14/share and she hopes whatever profits she may make helps her buy a home and pays off debt. In the meantime, she makes a living in the gig economy, including giving tarot card readings.

Sam Daftarian lost “thousands of dollars” in an e-commerce company after being tipped off by his cousin. He admits that his gains on AMC and GME (GameStop) “were probably just luck” and that his investments were based on “emotions and sentiment.”

Thushira Kumarage, 21, is a student studying math, statistics and actuarial science in Scotland. There are no Gamestop stores in Scotland, but he bought shares in GME in January of 2021. He remains optimistic because he trusts GME Chairman Ryan Cohen, even though Kumarage’s gains have “fluctuated by tens of thousands of dollars” and sits on a “modest profit.” Robert Misener, 51, shares the same confidence in Cohen, and believes shares will exceed last year’s high of $483/share. Even though his wife handles nearly all of his family’s finances, he says, “It’s kind of a faith thing.” Based on GME’s current price, the stock will have to gain more than 500% just to match last year’s high.

At the end of 2021, Morningstar conducted a review of the meme stocks. They concluded:

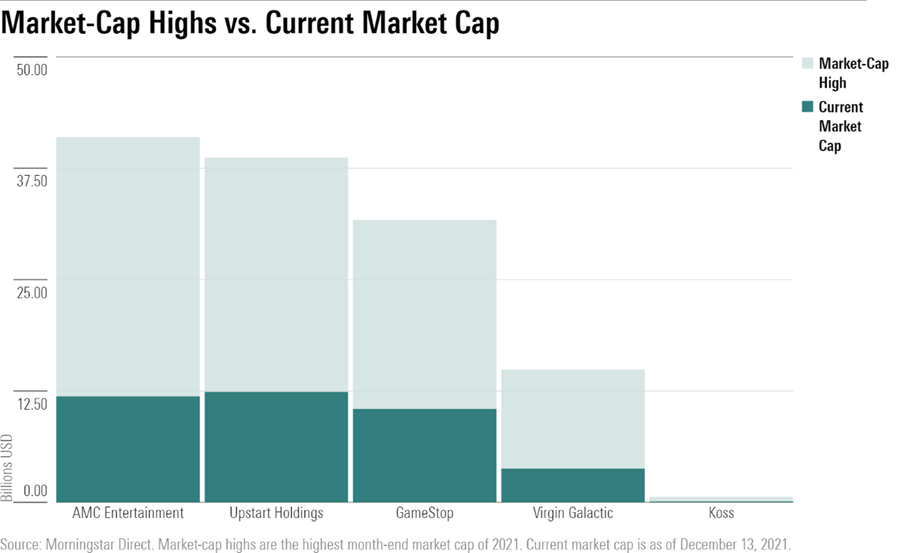

“We surveyed the landscape and tracked 16 widely followed stocks that had drawn the attention of meme traders alongside GameStop and movie-theater chain AMC Entertainment (AMC) in the first half of 2021. On average, the stocks in this group are down in price roughly 72% from their 2021 highs. Trading volumes, too, have dropped sharply, falling an average of 64% from their highs.

Interest in meme stocks was anchored by the fear of missing out, or FOMO, often driven by traders sharing their returns on social media and touting the stocks’ prospects. However, the lack of business fundamentals supporting these massive rallies and investor bases largely made up of short-term traders make them vulnerable to volatile price swings. That, in turn, leaves investors at risk of suffering huge losses.”

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.