Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

The tension leading up to and the beginning of the Russian invasion of Ukraine were the main factors that sped up and deepened the correction phase that equity markets were already in. We are still not unduly concerned as geopolitical events like this usually prove to only have temporary effects on the bigger picture, which is ultimately shaped by economic and monetary cycles.

Our view is still that the long-term bull market has more legs and we are in the midst of a short-term correction which could last for a few months. As we are mostly in equities, which are in long-term fundamental uptrends in their business prospects, we are seeing our portfolios performing much better than the markets during the correction thus far. Hence, we intend to generally hold our positions and ride this out, unless there are drastically negative developments.

Extra Reading:

The conflict between Ukraine and Russia has been longstanding, and back in March of 2014 when Russia annexed the Crimean Peninsula, legendary investor Warren Buffett remained unperturbed and reiterated his desire to buy stocks during times of war.

” ‘You’re going to invest your money in something over time. The one thing you can be quite sure of is if we went into some kind of very major war, the value of money would go down. That’s happened in virtually every war I’m aware of. The last thing you’d want to do is hold money during a war. You might want to own a farm, you might want to own an apartment house, you might want to own securities. During World War II the stock market advanced.’ ”

Buffett’s assertion that the stock market advanced during WWII is true. The New York Times published an article (note: paywall) a day before the invasion examining the impact of war and disaster on global markets:

“Global markets usually weaken as wars approach, strengthen long before wars end and treat human calamity with breathtaking indifference… Riding out a storm in the stock market has been a good strategy over the long term. One year after the 1941 bombing of Pearl Harbor, the S&P 500 gained 15 percent. A year after the U.S. invasion of Iraq in 2003, it was up 35 percent…

From President Truman’s March 17, 1948, speech to Congress criticizing what he called the Soviet Union’s expansion of Communism in Eastern Europe, until the end of December, 1991, when the Soviet Union ceased to exist, the Dow returned 10.05 percent, annualized. In the roughly 30 years since then, through Friday, the Dow returned 10.77 percent, annualized, a bit better than during the Cold War, but not by much.”

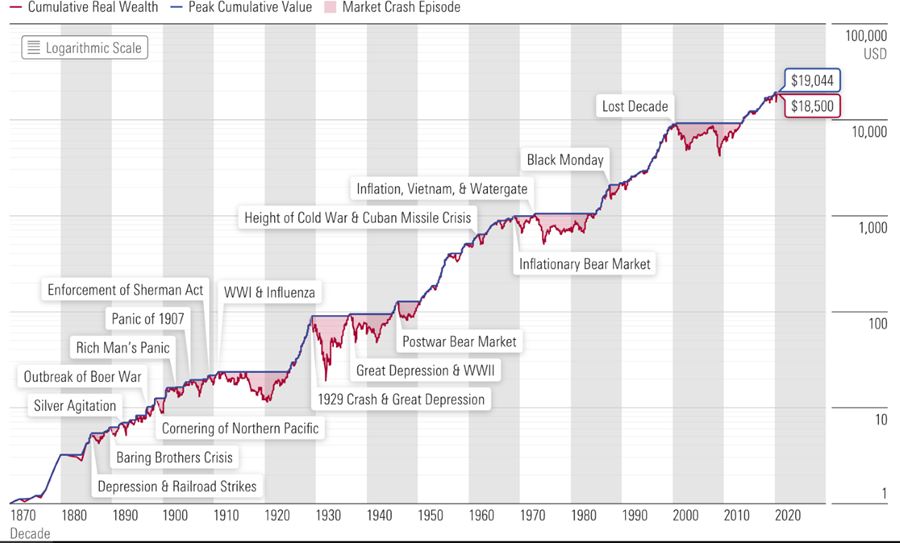

We’ve shared this chart from Morningstar before, but it’s worth sharing again to reiterate the long-term performance of stock markets despite numerous global crises, including both World Wars, the Great Depression and the Cuban Missile Crisis.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.