Dear Valued Client,

“People who exit the stock market to avoid a decline are odds-on favorites to miss the next rally.” – Peter Lynch

Aloni Goh Wealth Strategy Notes:

Financial and commodity markets were initially very volatile during the early days of the Russian invasion of Ukraine but volatility gradually dissipated over time. At this point, a rebound from the lows by equities and a pullback from the highs by commodities have occurred. We expect more back and forth movements over the next few weeks as the conflict develops. As with most black swan events, we have chosen to take the optimistic view that “this too shall pass.”

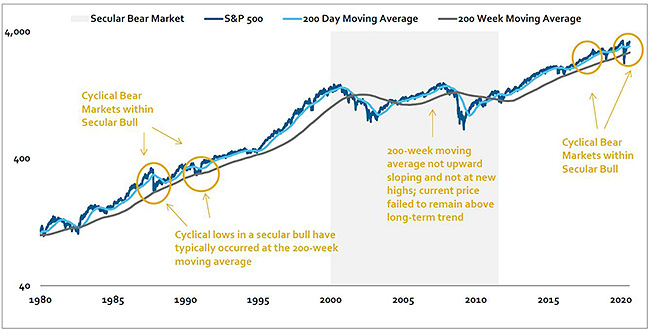

We are in the midst of a correction in this secular bull market and it could be a few more months before the long-term uptrend resumes. Different sectors have been doing different things during this time, and by being diversified, we have mitigated the pullbacks in our portfolio values. We intend to stay put with our asset allocations with minimal tactical changes during this corrective phase.

Extra Reading:

In the simplest terms, a secular bull market is a bull market that is driven by forces that could be in place for many years, causing the price of a particular investment or asset class to rise over a long period. Though interest rates have been rising, they are still at historic lows, and corporate earnings remain healthy and positive.

A secular market is a long-term event with persistent conditions regardless of economic slowdowns and cycles, which differs from a cyclical market which is shorter in duration and exhibits seasonal or cyclical conditions.

The current secular bull market started in the 2010s and there is consensus within the industry that the upward trend will continue. Barron’s, Morgan Stanley and JPMorgan have all published research stating the secular bull market should continue into the 2030s.

From Barron’s:

“No one has a crystal ball, of course. But at this particular moment, with the Federal Reserve about to start tightening, inflation eating into household finances, and the war in Ukraine showing no signs of abating, the chance of a cyclical bear market this year is clearly higher than usual.

The secular bull, on the other hand, is healthy enough that it could keep going for the foreseeable future…

I have spent the past five years studying 150 years’ worth of U.S. stock market history… Prices have risen to record levels because corporate profit margins have been near a 100-year high, real interest rates (after subtracting inflation) have been near an all-time low and inflation has been tame until recently.”

From Morgan Stanley:

“While cyclical bear markets and economic recessions can occur within secular bull markets, the magnitude or length of such pullbacks has been much less severe in secular bulls versus secular bears. As a result, Morgan Stanley does not believe the current cyclical downturn will be as prolonged as those seen in 2000 and 2007, from either a market or economic perspective, as those downturns occurred during a secular bear market.

Over the past century, US equities have progressed through five long-term, or secular, market phases. Morgan Stanley believes US equities are in the midst of a sixth phase, a secular bull market that began with the recovery from the Great Recession in 2011.

The second phase, which is beginning now, will likely be powered by:

- Prime earning age population bouncing back – As the Millennials reach peak working age and Generation Z begins to enter the workforce, the deceleration and contraction of prime earners will likely reverse, boosting the consumer’s ability to spend.

- The strength of a demographic tailwind – Demographics can provide a powerful tailwind to markets. The previous major demographic impulse in the US was from the Baby Boom generation, which turned 35 and entered the prime earning age in 1981. The current generational impulse, the Millennials, turned 35 in 2016.

- Labour force participation picking back up – Following nearly two decades of decline in the labour force, the participation rate has stabilised in recent years and has even begun to move higher; as working age population in the US is set to grow, coupled with more favourable dynamics in the participation rate, a growing labour force could serve as a meaningful tailwind to US economic growth in the coming decade.

- Productivity turnaround – Productivity appears to be picking up, driven by the Fourth Industrial revolution. Research and development spending as a percentage of GDP is expanding as well, and now exceeds levels from the 1980s.”

Source: Bloomberg, Morgan Stanley & Co. Research

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.