Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

Equity markets traded lower throughout the month on concerns over three main factors: inflation, sharply rising bond yields and the ongoing war in Ukraine. As mentioned in our earlier missives, we are in still in the midst of a correction from the outstanding gains made over the past two years. At this point, the various major indices are near or at the lows for the year once again, with a follow through on the downside quite possible. However, we do think that once a lower low for the year has been made, the setup for this correction to be over will look quite good.

While the situation is always fluid, it does seem to us that inflation fears have been overblown and we suspect that, in the near future, inflation numbers could come out better (ie. lower) than expected. If that occurs, bond yields will probably roll over and turn downwards, and this should jolt the equity markets into a new uptrend in this ongoing secular bull market. It is very difficult to guess what will happen in the war in Ukraine with any degree of certainty, and for this, we have chosen to take an optimistic view that “this too, shall pass.”

In the meantime, we sit patiently and wait for the corrective phase to play out, while watching developments closely to see if there is any need to revise our outlook.

Extra Reading:

There are two main schools of through when analyzing securities: fundamental and technical. In simple terms, fundamental analysis is rooted in math and traditional metrics such as P/E to find an intrinsic value. Technical analysis is rooted in charting price movements and using trends and patterns to determine future stock price.

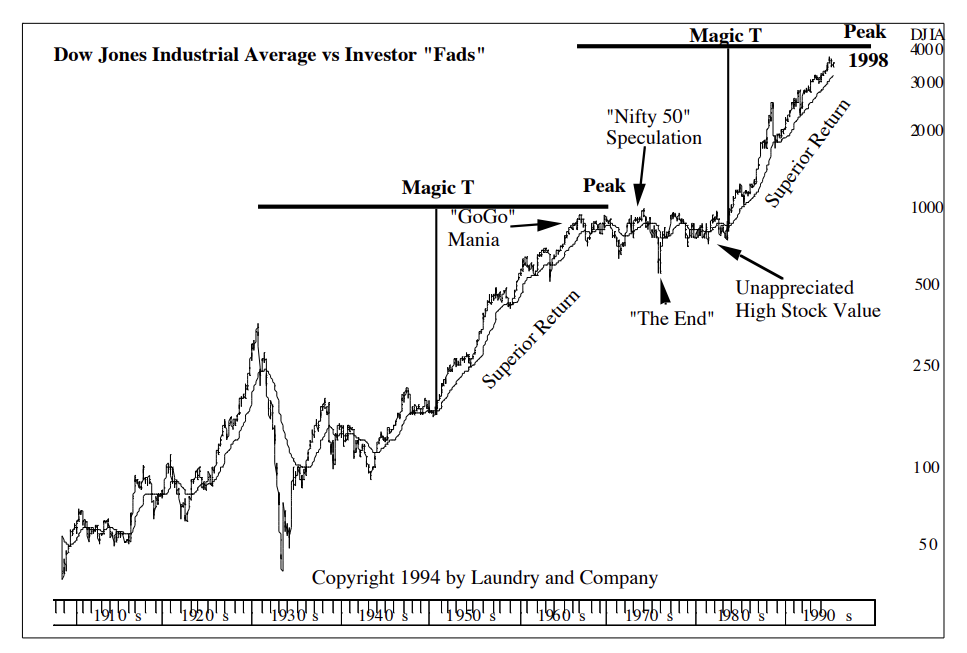

One of the theories in technical analysis is the T Theory, formerly known as “The Law of Matched Trend Time,” developed in the 1970s by Terrence H. Laundry based on time symmetry property. It “basically states the duration over which investors can obtain ‘superior equity returns’ will always be equal to the previous time period in which returns were subnormal. A simpler way to put it is to say the market can only ‘make a strong run’ as long as it has previously ‘rested’. As you might expect, the practical purpose of the theory is to anticipate the runs of ‘superior returns’.”

“This time match property can be shown to be reasonably accurate and reliable historically so I have proposed as a natural property inherent in market trends but of course we have no real knowledge, so results can not [sic] be guaranteed. The time symmetry is most easily represented by the graphical ‘T’ thus the name T Theory. In all instances the left side of the graphical T spans the market’s ‘rest period’ while the right side spans the ‘run period’ where returns should be the greatest.”

Source: “A 1997 Introduction to T Theory”, Terrence H. Laundry

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.