Dear Valued Client,

“The stock market is a device to transfer money from the impatient to the patient.” — Warren Buffett

Aloni Goh Wealth Strategy Notes:

Equity markets continued to trend down for most of May until a relief rally appeared close to month’s end. At this point, this is not unexpected as the markets have been very oversold. The market has traced out a bottom for now, but we do not think that it is THE bottom — going back quickly to new highs again from here is very unlikely. In our opinion, it will take a few more months before this corrective phase is done. Nonetheless, a break from the constant downdraft is good and we are glad for it.

Inflation remains the main worry for the markets and until it shows signs of abating, a new leg up in the secular bull market is not probable. We still think inflation will show signs of slowing within the next few months, hence our strategy right now is do little in equity repositioning while letting dividends and interest income mitigate the erosion in portfolio values while we wait. Sometimes it is better to sit, wait and watch.

Extra Reading:

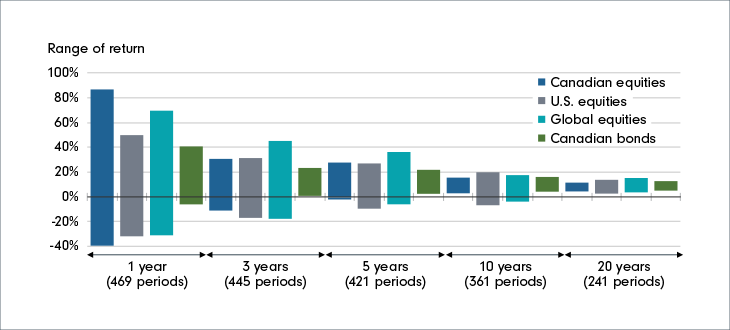

It’s difficult to be patient, especially when the outlook seems bleak and the markets face so many uncertainties. But one of the best teachers of investing is past history, and it offers up a gigantic data set to learn valuable lessons. In January 2018, U.S. News published an article preaching the value of patience even though the Dow had a record year in 2017, closing at 24,719.22 on Dec. 28. Since then, we’ve experienced the COVID-19 pandemic, major civil unrest, and now a war in Ukraine, supply chain issues and inflation, all of which have led to substantial drops and volatility in the stock markets. Today, despite being down nearly 10 percent year-to-date, the Dow is over 33,000, a gain of over 30 percent during that time.

From TheStreet:

“You’re not born knowing how to research a stock or how to apply critical thinking to an investment opportunity — those are investing skills some people learn and develop. Patience is an important, but often underused, investment skill we believe many need to develop more fully. We’re not born patient. When we’re young, we tend to care most about instant gratification…

Human beings were designed to react to threats, either real or perceived. Stressful situations trigger a physiological response in people. You’ve likely heard this called the “fight-or-flight” response — either attack or run away, whatever helps alleviate the threat…

When markets are seesawing and you’re overwhelmed with negative financial media, as we experienced this year during the pandemic-driven bear market, your brain perceives a threat to your financial well-being.

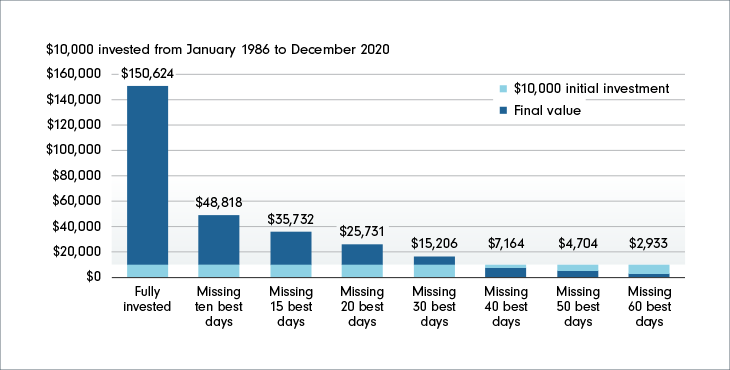

Selling out of the market during a correction might feel like you’re taking prudent action. And you may even derive some pleasure in seeing the market continue to fall after you’ve sold your equities. But that pleasure could soon be replaced by regret, because consistently and correctly timing the market by selling and buying back in at the right time requires an incredible amount of luck — and we don’t know any investors who have that much luck.

Being a patient investor might not be easy for you, as Warren Buffett’s business partner Charlie Munger points out. But there are tools to help you overcome impatience. Here are a few strategies you can use to cultivate patience and clarity of thought in your investing decisions.

- Have a plan and think long term.

- Understand that market volatility is normal.

- Look for fear or fundamentals.

- Remember, time is on your side.”

And how staying invested means you can capture all of the upside when markets turn up:

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.