Dear Valued Client,

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of despair alike, that this too, shall pass.” – Jack Bogle, founder of The Vanguard Group.

Aloni Goh Wealth Strategy Notes:

Equity markets continued to work lower in June, with yet another relief rally underway at the end of the month. Nothing much has changed in fundamentals with inflation still persistently high with little signs of abating. There has also been more talk recently of a looming recession and lower corporate profits over the next few quarters, which has added further downward pressure on equity prices. The situation in Ukraine continues to be destructive with little hope of a diplomatic solution.

This corrective phase is expected to continue over the next few months, with a possible final bottom in the September and October months. We are not making any major changes in our portfolios, and do not intend to, as long as we feel this is only a corrective phase. We have been busy taking advantage of the rising interest rate environment on the fixed income portions of our portfolios, reinvesting maturing bonds and cash inflows at very nice yields.

Extra Reading:

Denise Chisholm is the Director of Quantitate Market Strategy at Fidelity Investments, one of the largest and most reputable fund managers in the world and recently on her personal LinkedIn page shared the following:

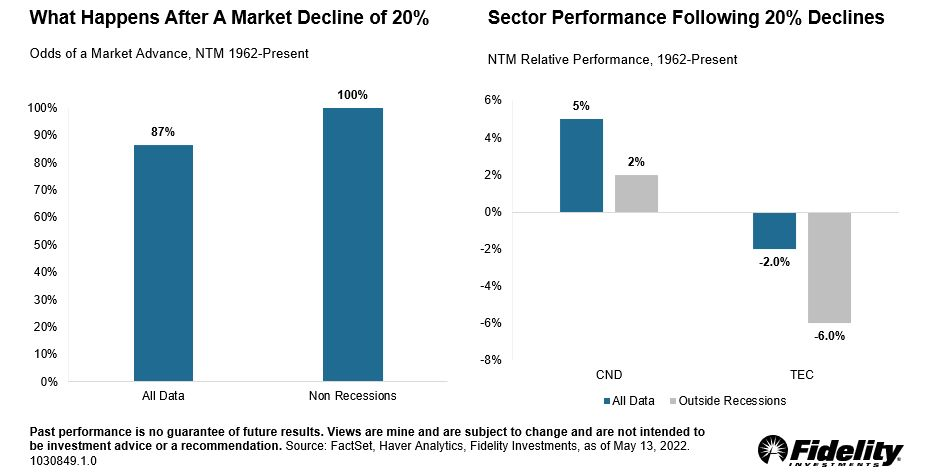

“Charts of the Week: Are corrections normal? No matter how different (and terrible) they all feel, equity market corrections really are typical. While the current drawdown is more than averages seen outside recessions, 15-20% declines make up a little less than a quarter of all non-recessionary corrections. Thus, large non-recessionary corrections are not rare, and, in fact, have gotten more frequent over the last decade.

While the drawdown we’ve seen is not all that different from a recessionary drawdown (on average), it’s not the correction that matters most – it’s the time it takes to get your money back. Outside recessions (my base case), stocks can go up as violently as they decline, getting back to even in 6-8 months versus over two years in the case of an average recession (if there is such a thing).

Given we are flirting with 20% declines at the index level, it’s helpful to know your odds from there even in the case of recession – and they are strong at 87%. The lower the market goes, the higher the odds of positive forward returns and thus, the rising risk of it being too late to be bearish…”

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.