Dear Valued Client,

“History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.”

– Shelby M.C. Davis, retired investor and current philanthropist

Aloni Goh Wealth Strategy Notes:

Equity markets finally found some support in July with a rally attempt underway at the moment. It seems that all the bad news — namely inflation, interest rate hikes, recession risk and the war in Ukraine — has finally been fully discounted.

It looks like the current rebound will have some legs, but a run at all-time highs will not be in the cards yet. The bottoming process will have to take some more time. We expect that it could be done through September and October and the next leg of the secular bull market could be apparent by year end.

Extra Reading:

The U.S. GDP fell 0.9% in the second quarter from April to June, the second straight quarter of decline. In economics, this is usually a sign of a coming recession, though note a declining GDP is only one indicator.

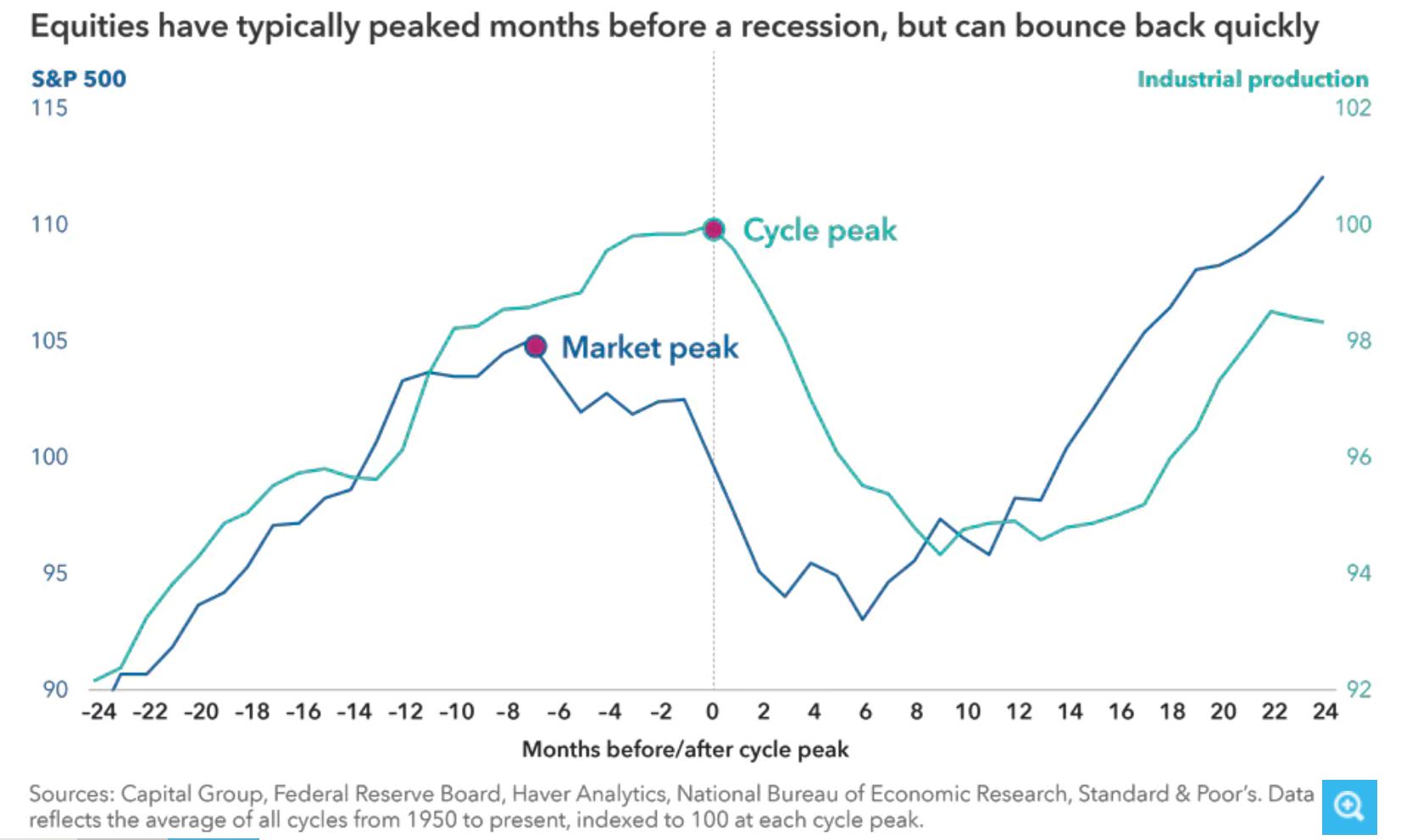

The stock market is a leading indicator and usually braces for bad news, such as a possible recession, before it begins and recovers before it ends. Hence, our view that the markets seem to have found some support in July and have already discounted the bad news. The most recent earnings reports have indicated positive sentiment and the stock indices have made gains during the final days of July.

Los Angeles-based Capital Group is one of the oldest investment management firms and in October 2019 — when signs of a recession were starting to appear, such as the inversion of the yield curve, and before COVID wreaked havoc on the world — published an article showing market performances during rough times.

“Could a recession be on the horizon? Maybe. Maybe not. Recessions are notoriously difficult to predict, even when signals are starting to flash red… Some of the strongest returns can occur during late stages of an economic cycle and immediately after a market bottom, so being wrong on either turning point can be devastating to long-term returns.

Recessions can be painful, but investors who are well-prepared and maintain a long-term investment horizon should be comforted that economic declines have been relatively small blips in economic history. Over the last 65 years, the U.S. has been in an official recession less than 15% of all months, with the average recession lasting just under a year.”

The article also notes that reaching for value does not always reduce volatility, does not always provide defense and is not the same as dividend investing. Regarding bonds, turning to short-term bonds is “usually most beneficial n a rising-rate environment,” which we have done in our portfolios with fixed income.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.