Dear Valued Client,

“I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I’ve seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.”

– Charlie Munger, vice chairman of Berkshire Hathaway.

Aloni Goh Wealth Strategy Notes:

Stock markets staged an impressive recovery earlier in August but it is fizzling out as summer draws to an end. We expect some volatility ahead over the next two months as the market tries to test the low that was formed during June and July. How low it will go this time will depend very much on future inflation data.

We remain invested for the long term and also remain confident that the secular bull market is intact. We expect a final low for this corrective phase sometime in September and/or October, and a substantial rally towards the end of the year which will probably indicate that the next leg up is firmly underway. We have been reinvesting cashflows in the portfolios throughout the year and will certainly continue to do so over the next few months.

Extra Reading:

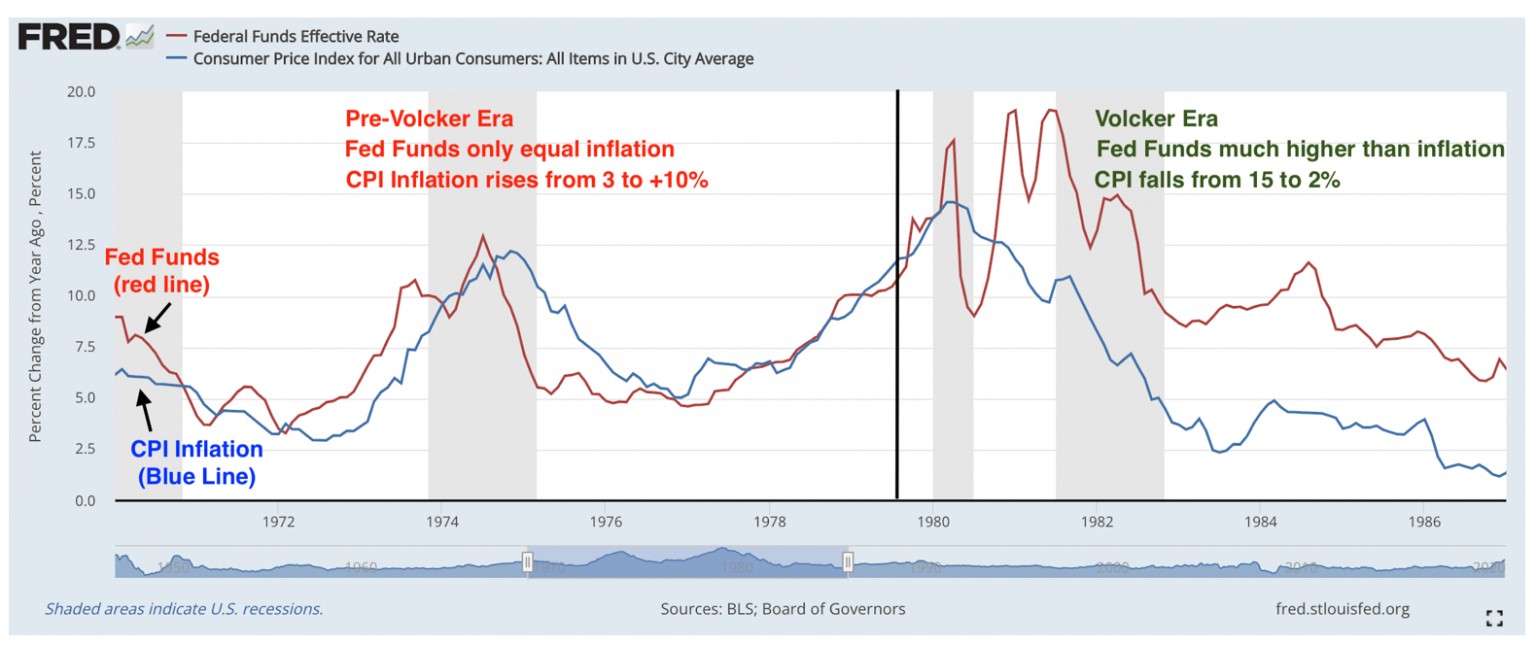

This is not the first time, nor will it be the last time, we fight inflation. In the 1970s, highlighted by the oil crises in 1973 and 1979, inflation emerged as a significant financial and political problem for the U.S. By March 1980, inflation had peaked to 14.8%, only to fall back to 3% by 1983. The recovery was guided by then Fed chair Paul Volcker, who fought inflation by raising the interest rate. It led to a relatively short recession from 1980-82, but the subsequent economic recovery was strong and expansive. Volcker won the U.S. Senator John Heinz Award for Outstanding Public Service By An Elected or Appointed Official in 1983 for his work as the Fed chair.

Last Friday, Fed chair Jerome Powell’s comments at Jackson Hole sent markets into tailspin the following Monday after he re-affirmed his goal of maintaining price stability and will combat inflation aggressively even though it will cause some pain. His comments drew comparisons to Volcker, and Minneapolis Fed president Neel Kashkari said the stock market’s response to Powell’s hawkish comments means investors know the Fed is serious about combating inflation.

To use a metaphor, the Fed is tightening the belt, but going on a tough diet is better than being obese in the long run.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.