Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

Equity markets turned lower after a rally attempt early in September. A higher-than-expected U.S. CPI number was the main catalyst for this latest downward thrust, aided by a rate hike and persistent hawkish rhetoric — in other words, a desire for higher interest rates — from the Fed. The expected low point in this corrective phase around the September and/or October timeframe is now being played out.

We continue to reinvest cash received via interest and dividend payments from our portfolios’ holdings as we wait out this corrective phase. Patience is the most valuable commodity in times like this and one must remember that once the market starts to make up for lost ground, it frequently surprises investors with the speed in which it does so.

Extra Reading:

Courtesy of our partners at Fidelity Investments:

For your clients asking “when is the bottom?”, we’ve put together an illustration that proves that time in the market is more important than timing the market.

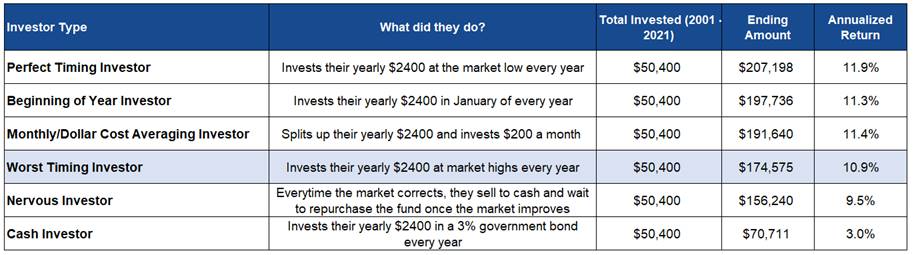

Our illustration is simple. Each of these investors is given $2400 at the beginning of the year to invest into Fidelity Canadian Large Cap Fund according to their profile. After 10 years (2001-2021):

- Perfect Timing Investor: Through skill or luck, this investor placed their $2400 into the market every year during the month the market hit its low point. For example, in 2001 Canadian Large Cap bottomed during November, so this was the month they invested. They continued to time it correctly every year.

- Worst Timing Investor: They invested their $2400 during the month the market peaked each year. For example, in January 2001 the Fidelity Canadian Large Cap peaked in January so this was the month they invested that year. They continued to buy in at the peak every year.

- Beginning of Year Investor: Keep it simple. Every year when they get their $2400, they invest immediately in January.

- Monthly Investor: Timing the market perfectly is difficult so they decide to divide their $2400 into 12 equal amounts to invest every month.

- Cash Investor: This investor wanted no risk, so they invested their $2400 every January into a 3% yielding government bond instead.

- Nervous Investor: Every time the market goes through a sharp correction, they sell. When the market starts to improve, they re-purchased the Fund.

Nervous Investor time periods leaving and returning to the market are in a table below

Who wins?

What’s even more surprising is where the remaining investors finish. The Worst Timing Investor finished ahead of the Nervous Investor and the Cash Investor. Bad timing still beats being out of the market.

Source: Morningstar. Chart is for illustrative purposes only.

The moral of the story is that timing the market is nearly impossible and even if you do it correctly, you don’t win by much. The best idea seems to be spending as much time in the market as possible and staying the course.

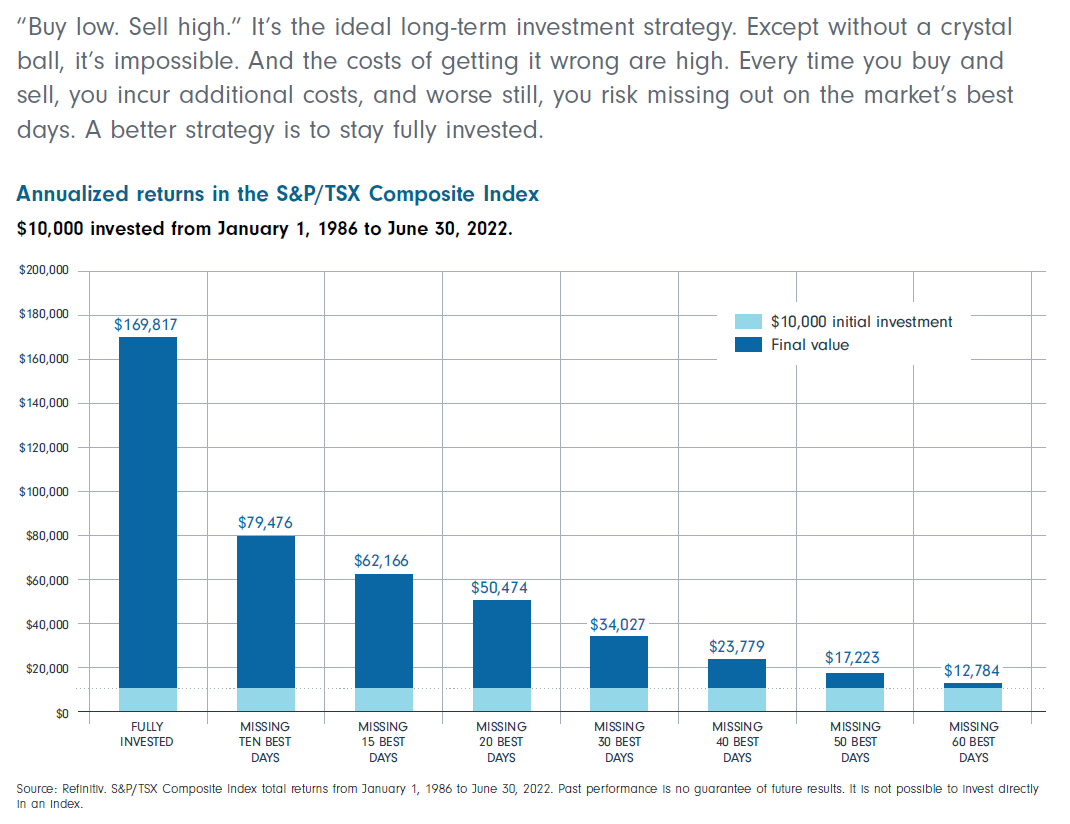

To further illustrate, below is a chart of annualized returns for those who try to time the market. Notice the impact of not staying invested and how quickly markets can recover from a downturn.

Chart is for illustrative purposes only.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.