Dear Valued Client,

“… because timing the market perfectly is nearly impossible, the best strategy for most of us is not to try to market-time at all. Instead, make a plan and invest as soon as possible.”

– study on market timing by Charles Schwab, an American multinational financial services company.

Aloni Goh Wealth Strategy Notes:

Equity markets made a bottom this month and started a tentative rally which looks promising at the moment. While inflation remains elevated, central banks have recently indicated that they may be less aggressive with rate hikes from here on. Whether this bottom turns out to be THE bottom depends a lot on the next two CPI numbers.

In any case, we think that the downside risk to equity markets is now quite limited. At times like these, one must look back at how the markets have emerged from previous corrections. New uptrends emerge unexpectedly and very quickly, as recent occurrences in 2016, 2019 and 2020 show. We expect that this time it will be the same. Hence investors should stick confidently to their long-term investment strategies amidst all the doom and gloom prognostications that seem to be so popular these days.

Extra Reading:

One of the key services Aloni Goh Wealth Management provides to all clients is helping them discover the appropriate amount of risk to take in their portfolios. It is arguably the most important aspect of any investment planning, and taking either too little risk or too much risk could mean that financial goals may not be achieved. Our portfolios have not been immune to the market drops this year, but we have also continued to generate returns for our clients through dividends and interest payments, continuing to help cover their costs of living and investing for the long term. We have navigated through many storms and will continue to do so in the coming years and decades.

Using strategies such as asset allocation, stock picking and using individual bonds as part of our fixed income component to control the dates of maturity and relative yields, we can cater our portfolios to each client’s needs. No one is the same, so why should everyone fit into the same basket?

This is why we offer six different portfolios: High-Yield Bond, Income, Conservative Balanced, Balanced and both Canadian dollar and U.S. dollar versions of Growth. Each of the portfolios are designed to achieve different goals, which we have outlined below. Please note that as our portfolios can be customized for each client’s needs, the following descriptions are for general discussion only. Note that the neutral asset mix for each portfolio may fluctuate slightly depending on market conditions and that the recommended portfolios may differ for each client depending on their financial situation.

High-Yield Bond PortfolioNeutral Asset Mix: 100% Fixed Income, 0% EquityInvestor Profile: For investors who wish to protect and preserve their principal while seeking a stable stream of income at a reasonable yield above the risk-free rate.

Recommended for investors approaching retirement or currently retired and would like their portfolios to generate cash flow to cover their living expenses, and/or for those wishing to leave assets for their estate and beneficiaries.

Note: The risk in the High-Yield Bond portfolio can be adjusted depending on the allocation of investment-grade bonds to corporate bonds. The corporate bond allocation will include bonds, debentures and convertibles that are not investment grade or otherwise ungraded.

Income PortfolioNeutral Asset Mix: 70% Fixed Income, 30% EquityInvestor Profile: For investors seeking above-average income with modest potential for capital growth using some allocation of high-yielding securities and other dividend or interest-paying securities.

Recommended for investors approaching retirement or currently retired and would like their portfolios to generate cash flow to cover their living expenses, and/or for those wishing to leave assets for their estate and beneficiaries. It is designed to be more tax efficient than the High-Yield Bond portfolio due to its dividend income stream.

Conservative Balanced PortfolioNeutral Asset Mix: 50% Fixed Income, 50% EquityInvestor Profile: For investors seeking conservative growth from income and capital gains while minimizing fluctuations in capital value.

Recommended for investors who are building their wealth and investing for the long-term and for retirement. The portfolio’s equal weight in both fixed income and equity allows for equal exposure in the two major asset classes.

Balanced PortfolioNeutral Asset Mix: 40% Fixed Income, 60% EquityInvestor Profile: For investors seeking above-average long-term returns from income and capital gains while minimizing fluctuations in capital value.

The most popular option among our clients, the Balanced portfolio is recommended for investors who are building their wealth and investing for the long-term and for retirement. The portfolio’s higher weighting in equity is appropriate for investors who can withstand some market fluctuations and downturns.

Growth (both CAD and USD) PortfolioNeutral Asset Mix: 0% Fixed Income, 100% EquityInvestor Profile: For investors seeking to maximize long-term returns from income and capital gains while minimizing fluctuations in capital value.

Recommended for investors who are building their wealth and investing for the long-term and for retirement, and/or for investors who wish to leave a substantial sum for their estate and/or beneficiaries to inherit. The portfolio’s 100% weighting in equity is appropriate for investors who can withstand most or all market fluctuations and downturns.

On a personal note:

We are finally through October. Many of our clients have families and kids to tend to, and the fall is always a busy time of the year with school and other extracurricular activities starting up again.

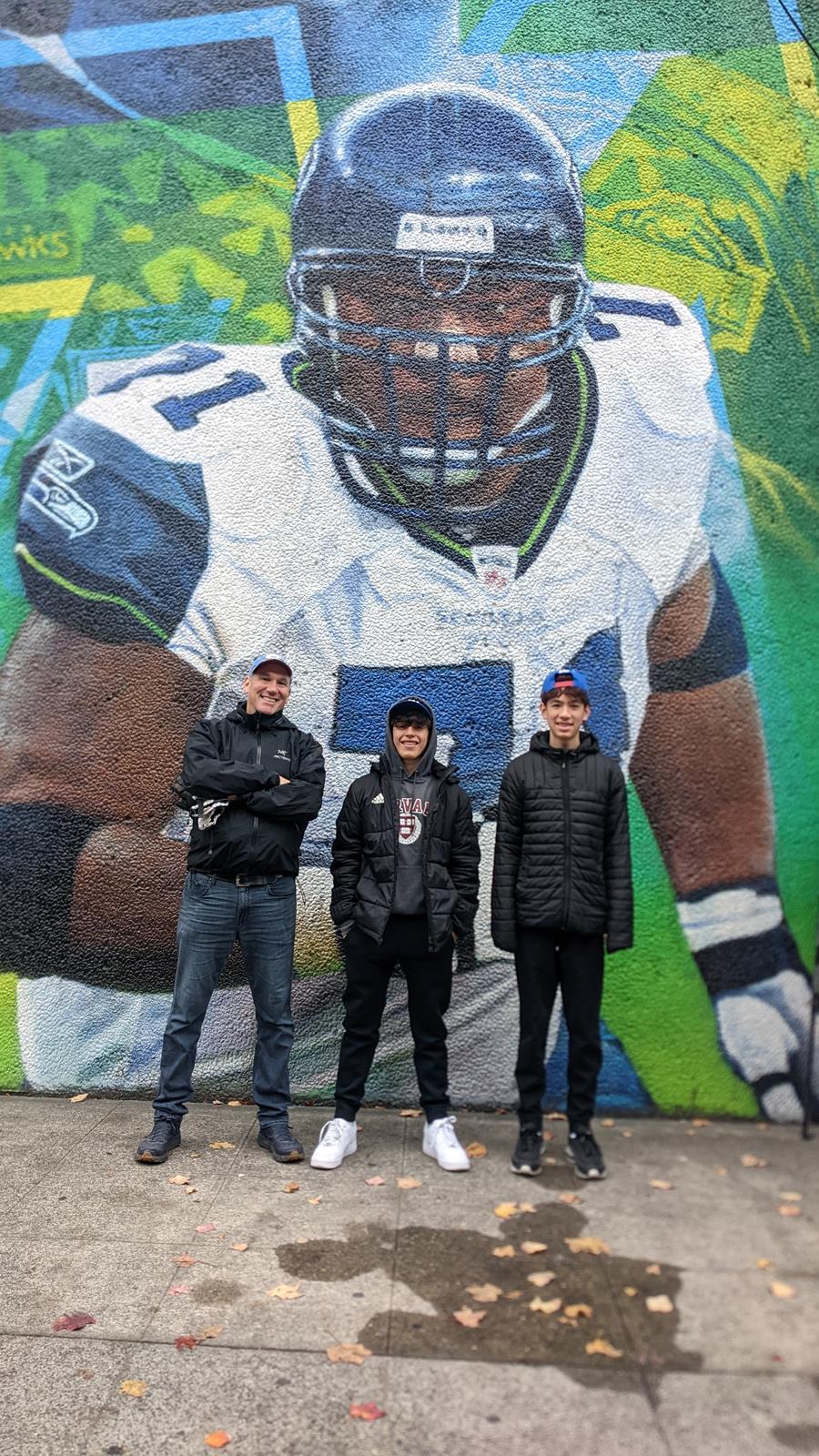

It is always a good idea to take a mental break once in a while to refresh, whether it’s going on a walk to enjoy the cool Pacific Northwest air or take a short road trip to take in a Seahawks game, which is exactly what Ron did over the weekend, taking his son, Lukas (right) and Lukas’ friend (middle) south of the border.

Here’s a picture of the handsome trio standing in front of a mural of Hall of Fame tackle Walter Jones. The mural was painted by local Seattle artist Jeff “Weirdo” Jacobson and located on 1st Avenue South in Seattle’s SoDo neighbourhood. A good time was had by all, though Ron expresses his regret that the Giants succumbed by a score of 27-13.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.