Dear Valued Client,

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences.”

– Peter Lynch

Aloni Goh Wealth Strategy Notes:

Equity markets were volatile in March due to the banking “crisis” following the collapse of Silicon Valley Bank and two other banks, Silvergate Bank and Signature Bank, that conducted business with cryptocurrency firms. While there were ample opportunities for the markets to crash, they did not. This is because the problems that arose in those banks were specific to these banks, caused by gross mismanagement of their risk and treasury operations. For most of 2022, SVB had operated without a chief risk officer, an issue that the Fed will investigate as part of their probe into the bank’s failure. It was not a systemic problem in the global banking system. In fact, many of the world’s largest banks have benefitted as funds flowed from smaller, riskier banks to the more established names.

Among the exchanges, the NASDAQ also benefitted as funds flowed from financials into tech and growth. This had the effect of providing some stability and, overall, the equity markets have been continuing the bottoming process which started in October last year. Our view is that the longer this bottoming process goes on, the stronger and more resilient the ensuing next uptrend will be.

Extra Reading:

While the collapse of SVB sent shockwaves through the financial markets, which was later exacerbated by UBS’ swift takeover of Credit Suisse, which had struggled for many years following the global financial crisis in 2008, it is “unlikely to have significant direct impact on Canada’s Big Six banks…” Though the stock prices of the six banks tumbled, they remain well capitalized due to their dominance in the Canadian markets and their diversified businesses, including those who have a significant footprint in the U.S., such as RBC and TD.

In the days that followed, Peter Routledge, the Superintendent of Financial Institutions, released a statement clarified SVB’s presence in Canada, noting that SVB “operates in Canada as a Foreign Bank Branch based in Toronto… This branch does not hold any commercial or individual deposits in Canada.” Routledge later remarked: “ ‘I want to be clear: the Silicon Valley Bank branch in Canada does not take deposits from Canadians, and this situation is the result of circumstances particular to Silicon Valley Bank in the United States.’ ”

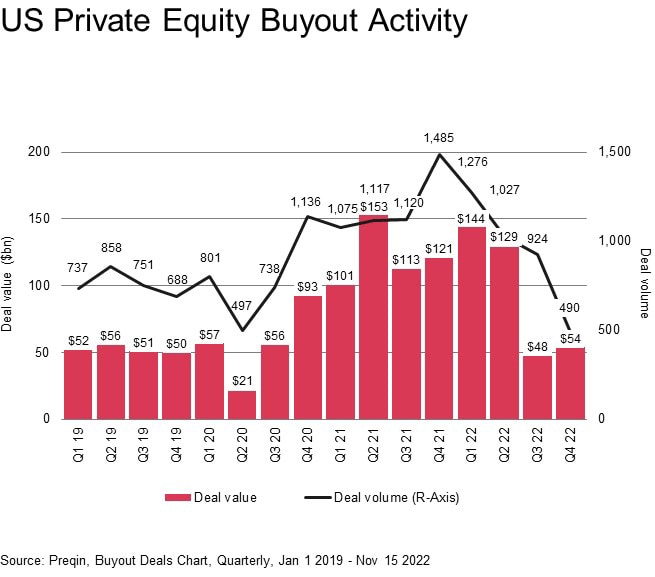

Private equity and alternative investments sectors attracted a ton of investor money during the previous few years in unprecedented low-interest environments. As Warren Buffett once said, “only when the tide goes out do you discover who’s swimming naked.” Investments into private equity are usually limited to accredited investors due to high levels of risk and the sophisticated knowledge it may require to understand. In the fervor of high-flying growth in the tech space, many had forgotten this important aspect of investing in private equity.

In particular, the valuation of private companies is often declared by the company itself without being properly audited or traded on the public markets to determine its stock price. The level of risk private equity investment presents is often unquantifiable. In our present environment of high inflation and high rates, private equity has, essentially, been caught with their pants down and forced to revise their valuations because borrowing money and raising money has been much more difficult. No longer can they rely on numerous rounds of financing to pump up their company value. SVB’s collapse had very much to do with its concentrated, niche-market business – private equity, particularly in the tech space – and in doing so violated one of the most important tenets of proper investing: diversification.

Aloni Goh Wealth Management’s portfolios remain steadfastly invested in various types of equity and fixed income spread across various sectors to mitigate risk. Remember, the best portfolio is always the one that’s best suited for you. In staying in constant contact with you over the course of the months and years, our goal is to help you discover your risk objective and offer tailor-made advice to help you reach your financial goals.

Courtesy of PWC.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.