Dear Valued Client,

“… nothing is certain except death and taxes.”

– Benjamin Franklin

Aloni Goh Wealth Strategy Notes:

Allow us to gently revise Benjamin Franklin’s famous quotation – “… nothing is certain except death and higher taxes.”

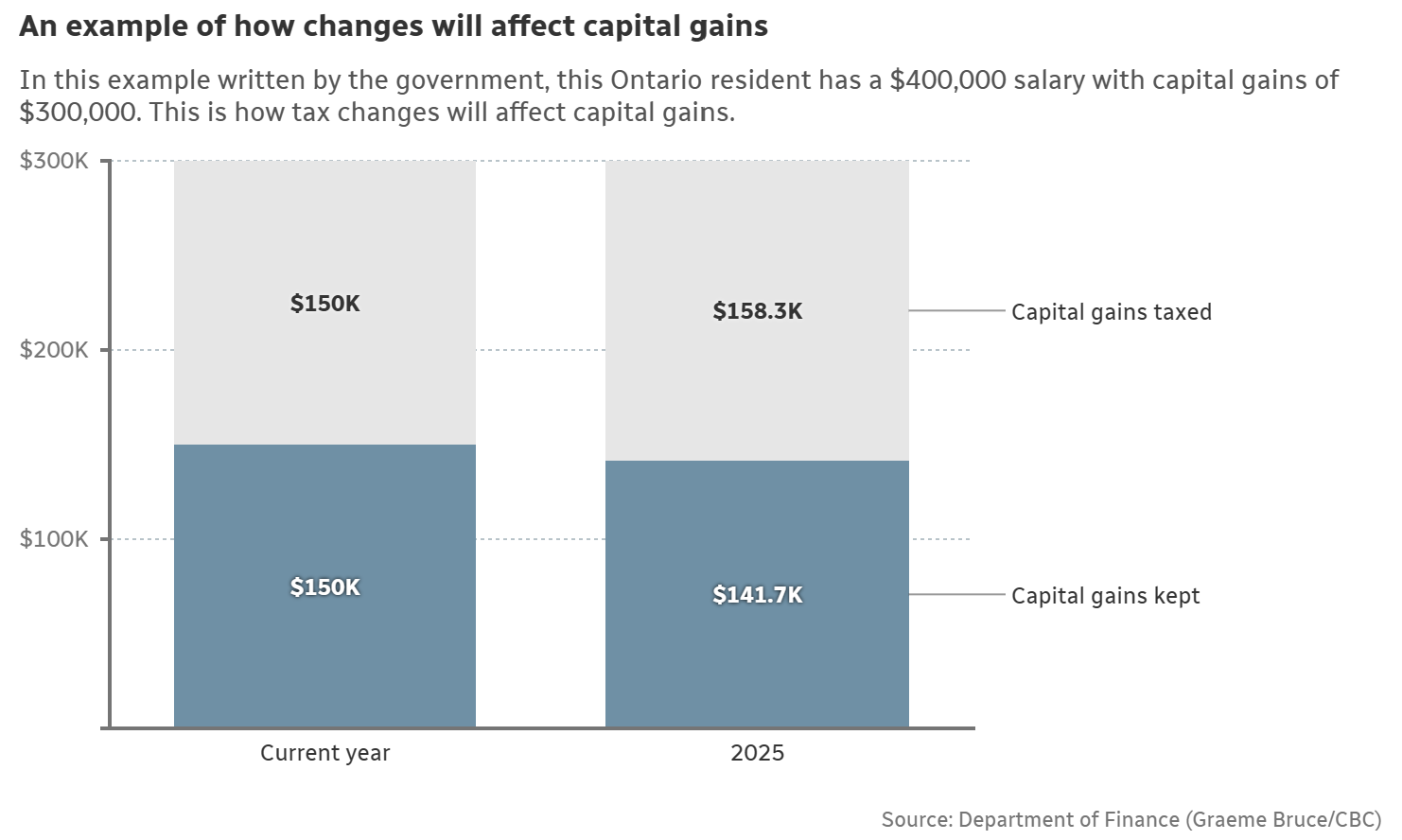

The 2024 federal budget increased the capital gains rate for individuals, trusts and corporations for capital gains realized on or after June 25, 2024 to two-thirds, or approximately 66.67%.

Example:

Assume you sell a property that is not your principal residence or an investment portfolio and generate a capital gain of $300,000 after June 25, 2024, and assume you are in the 50% marginal tax bracket.

First: $250,000 in gains will be taxed at rate of 50%. This means $125,000 in taxable gains taxed at 50% marginal tax bracket = $62,500.00 tax bill

Second: $50,000 will be taxed at a rate of two thirds, or approximately 66.67%. This means $33,335 in taxable gains taxed at 50% marginal tax bracket = $16,667.50 tax bill

EQUALS

$158,335 in taxable gains for a total tax bill of $79,167.50

Previously, a simple 50% inclusion rate on $300,000 in capital gains resulted in a tax bill of $75,000. With the new inclusion rate, the difference is approximately $4,167.50 in additional taxes.

The illustration below shows you the same effect. Previously, only $150K of $300,000 in capital gains will be taxed. With the new rate, $158.3K of the gains will be taxed.

Source: https://www.cbc.ca/news/politics/capital-gains-tax-budget-1.7176370

For tax planning regarding the new inclusion rate, please consult your tax accountant for professional tax advice as individual circumstances will differ. Aloni Goh Wealth Management is not a tax representative.

Even with the new inclusion rate, it has not materially affected the way we manage our clients’ hard-earned dollars. Our mandate as long-term investors in more predictable assets that generate income through dividends and income remains unchanged.

We are cognizant of the benefits of tax-free or tax-deferred registered accounts, and it can be a significant consideration for financial planning or asset allocation for your individual and households accounts.

Source: https://mackaycartoons.net/2024/02/27/tuesday-february-27-2024/

For tax planning regarding the new inclusion rate, please consult your tax accountant for professional tax advice as individual circumstances will differ. Aloni Goh Wealth Management is not a tax representative.

Further Reading:

The new capital gains inclusion tax rate may affect investors in other ways, especially individuals, trusts or corporations that own rental or vacation properties that have appreciated in value. Estates may also be taxed at the higher inclusion tax rate; upon death, there is a deemed disposition at fair market value of all the deceased’s assets.

The federal budget claims it will deliver on its fiscal objectives despite running a deficit of $40 billion for 2023-24, and boost affordability and fairness for education, housing and everyday costs for the coming generations.

While the goals are admirable, we must harken back that this is the same Liberal government that allowed problems of affordability and high costs to fester, drew significant controversy for spending $1.3 million on three retreats to discuss affordability, and spent $59.5 million – an approximate figure but believed to be higher since information and records regarding the costs were not properly kept – for the much-maligned ArriveCan app developed during the pandemic.

Look, we don’t mind paying taxes. If you do, it means you’re making money, and that’s a good thing. But it certainly grinds our gears that hard-working Canadians and investors such as you are held responsible for the fiscal irresponsibility of others, and in ways often beyond our control.

(Note the new capital gains inclusion tax was not tabled in the budget in the House of Commons, though it is expected to be introduced in a separate legislation.)

More information regarding the new capital gains inclusion tax is available on the Financial Post: https://financialpost.com/personal-finance/taxes/what-to-know-increased-capital-gains-tax

More information and insights regarding the 2024 federal budget is available via KPMG: https://kpmg.com/ca/en/home/insights/2024/04/2024-federal-budget-highlights.html

For tax planning regarding the new inclusion rate, please consult your tax accountant for professional tax advice as individual circumstances will differ. Aloni Goh Wealth Management is not a tax representative.

If you are interested in speaking with Aloni Goh Wealth Management regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leedejonesgable.com.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.