Dear Valued Client,

“We’ve come a long way in the fight against inflation. And our confidence that inflation will continue to move closer to the two per cent target has increased over recent months.”

– Tiff Macklem, Bank of Canada governor

Aloni Goh Wealth Strategy Notes:

Why does it feel like a holiday?

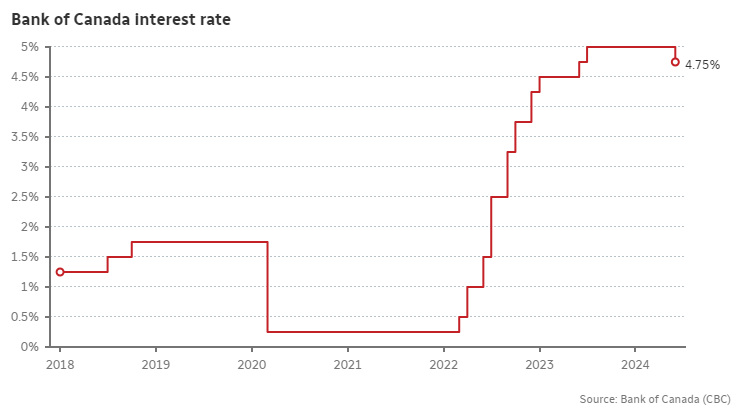

For the first time in four years, the Bank of Canada started offering its best deal cutting interest rates by 25 basis points to 4.75 percent. While the cut was expected, it certainly brings a small sense of relief after it was officially announced Wednesday morning. There were reasons for rates to stay elevated – inflation had not yet dropped to its target 2-percent level, and there was always an opportunity to cut rates in July if the June numbers were good – but a rate cut is a signal the BoC has pivoted and marked the start of a new path.

This new path could mark the start of a new monetary policy in the post-COVID era after interest rates were ratcheted up at a historically fast pace. The BoC hiked its rate from 0.25 percent in March 2022 to 5 percent in July 2023, an increase of almost 2,000 percent. During that time, term deposits and cash became much more attractive investment options after years of low interest rates that saw cheap money (ie. we printed a lot of bills) and a feverish growth in private equity.

This also marks a good time to make slight changes to your portfolios. The TSX composite index has had lacklustre performance over the past 2.5 years with a total price gain of approximately 5 percent since the start of 2022. Our portfolios have participated in the market growth, and the new pivot by the BoC gives us an opportunity to refresh our market outlook, investing in sectors where we see opportunity and reducing exposure in sectors that have not provided the returns we had been looking for.

This strategy shift will potentially affect our equity positions and our fixed income positions. In the current interest rate environment, the spreads between investment-grade bonds and high-yield bonds have narrowed. In other words, we have the opportunity to shift our fixed income positions to higher quality issuers (investment-grade) and reducing issuer risk while getting yields similar to high-yield bonds and debentures.

Further Reading:

The BoC further indicated that there are potentially more cuts to come if inflation continues to ease. The Canadian dollar immediately weakened slightly following the BoC’s announcement, dropping slightly by 25 basis points relative to the U.S. dollar. Interest rate cuts usually weakens the currency – that means less buying power for the Canadian dollar – but the impact felted muted, indicating much of the interest rate cut was priced into the currency already.

Where the Canadian dollar goes from here – either weakening slightly further or firming up in its current range – is TBD as we (along with other experts) maintain that trading currency is a mug’s game.

There were valid reasons not to cut rates: April’s inflation number of 2.7 percent was still higher than the 2 percent target, and there would’ve been an opportunity to cut rates in July, giving the BoC one more month of data before making a decision.

But there were also good reasons to cut: Inflation stayed below 3 percent for an entire quarter, Canada’s low productivity has been a headline problem and wages need to decelerate. Canada’s economy is very much driven by immigration and it’s an unsustainable method of growth. By cutting rates, it should spur more business investment and ease upward price pressures. The BoC is now the third bank to cut rates, following Sweden’s Riksbank and the Swiss National Bank, and the European Central Bank is expected to follow.

While Canada followed the U.S. in hiking rates, Canada is now on a divergent path. Note the economies of Canada and the U.S. are very different, and the U.S. economy has remained surprisingly resilient.

Macklem cautioned that while further cuts may come, it will be done on a meeting-by-meeting basis since the path to lower inflation may still be uneven and risks remain. Rate cuts are expected to be done slowly and not at the same speed as the rate hikes, in what has been termed a “shallow easing path.” The BoC will keep an eye on supply and demand, inflation expectations, wage growth and corporate pricing behavior before making any further decisions.

If you are interested in speaking with Aloni Goh Wealth Management regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leedejonesgable.com.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.

Source:

Source: