Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

We are truly living in a whole new world. It’s not the romantic kind, like when Aladdin whisks Jasmine away from the palace on a magic carpet and shows her a life of freedom and wonder. Nope. This is the whole new post-Covid world of potentially higher-for-longer interest rates and changing geopolitics.

After the Bank of Canada cut rates a month ago, and with the U.S. showing a slowdown in wage growth and hiring – although unemployment rates remain very low at 4.1% – there are multiple signals around the world that show inflation is abiding and more interest rate cuts are to come. However, those cuts will not be nearly as quick as the historic pace of the hikes where they were increased by nearly 2,000% in a very short amount of time. Remember, too, that the years of very, very low interest rates were the anomaly, not the norm. From 1971 until 2024, the average fed rate in the U.S. was 5.42%.

The other topic on everybody’s mind lately is the upcoming U.S. election. Where do we begin with that one?! From calls for Biden (who turns 82 in November) to step aside to the never ending talk of Trumps felonies, combined with a large segment of the population who do not like either candidate, the stage has been set for a raucous affair.

Source: usnews.com, Credit: Chris Britt/Creators

When it comes to our portfolios, the truth is we are prepared for both higher-for-longer and lower interest rates, and agnostic when it comes to the U.S. election. What’s important is that the economy and the world is changing, and we’ve been slowly adjusting our portfolios to reflect this new reality. As noted in our June newsletter, we are seeing opportunities in different sectors as federal banks pivot in their interest rate paths, affecting both equity and fixed income markets, and moving away from sectors that had not provided the returns we were seeking.

We remain bullish on our long-term outlook and maintain our thesis that holding mature and high-quality companies is the best path forward. Higher interest rates also means we are seeing an opportunity to higher quality issuers while earning similar yields to high-yield bonds and debentures.

Further Reading:

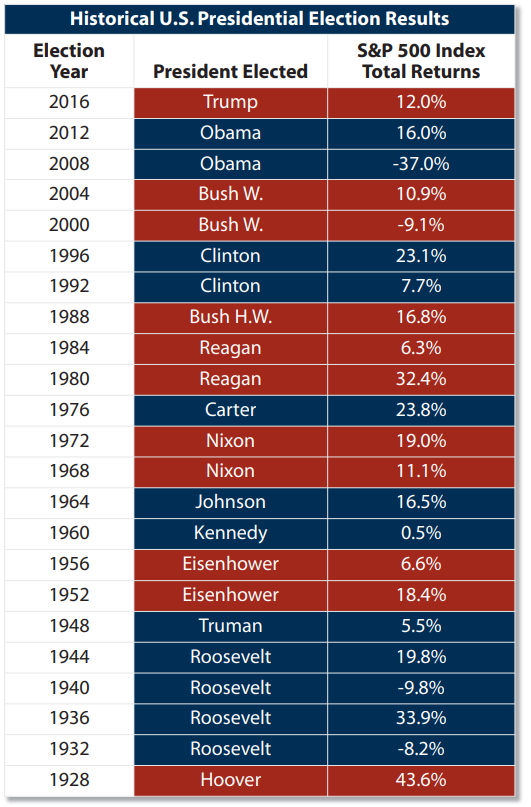

No matter how you feel about Biden or Trump (or even Kennedy, for that matter), the S&P 500 has had more positive returns than negative returns in election years. In a report from Morgan Stanley, the average return in all election years is 11.28%, and between 1928-2016, 19 of the 23 years (83%) provided positive returns.

The S&P 500, of course, represents the 500 largest public companies in the U.S., which further emphasizes the importance of investing in mature, blue-chip companies. We may hear this term more often in the coming months or years, but there’s a notable rise in “zombie companies” around the world – companies who are under heavy debt loads and generating enough business and cash to repay the loans but not the principal. If interest rates remain elevated, these companies may become insolvent.

The equity portion of our portfolios, including both individual companies and both index ETF and factor ETF positions, are cognizant of this and remain focused on investing in blue-chip quality companies that will stick around for a very long time.

If you are interested in speaking with Aloni Goh Wealth Management regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leedejonesgable.com.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc. of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.