Dear Valued Client,

“No one can predict with any certainty which way the next 1,000 points will be. Market fluctuations, while no means comfortable, are normal.”

– Peter Lynch

Wealth Strategy Notes:

Market fluctuations are indeed normal, as Peter Lynch points out in the quote above, but the volatility that rocked the markets last week spooked just about everyone. The dip in the markets began in mid-July and on Monday, August 5 – nothing good ever happens on Mondays, it seems – the U.S. markets suffered their worst losses in two years. Canada followed suit on Tuesday since Canadian markets were closed on Monday.

The Magnificent 7 were suddenly not-so-magnificent as the tech sectors were hit the hardest. They were the companies that kept going up and up and saw their valuations stretch to incredulous heights. Everyone knew this was happening; it was just a matter of when markets would find an excuse to cause a massive sell-off. Along with the high valuations, there were also concerns about the weakening U.S. economy and the Fed cutting rates too slowly, the on-going geopolitical crises, and the unwinding of carry trades, where currency is borrowed from a country with lower interest rates to buy assets in a country that paid higher interest rates.

Put it this way: Imagine you’re on a cruise with a delicious buffet every lunch and dinner. You happily gorge away because everyone says it tastes good, and you either agree or try it anyway because, y’know, FOMO. (What else do you do on cruise ships?) You expect your waistline to get bigger, and indeed you can feel it getting bigger, but it’s not until you get home and step on the scale that you realize that maybe the gym membership should be dusted off. The buffet is the broader stock market, with the Nasdaq serving as the dessert station, and the scale is the sudden dose of reality that inevitably hits even though you know it’s coming.

The good news: The markets showed some strength with a bounce back and the major indices finished close to flat for the week. Remember, drops like these are normal. According to an Oxford Economics report quoted by CBS News, a 5% drop in stock prices have occurred annually for the past four decades, and market corrections – defined as a 10% drop from their peak prices – occur approximately every two years.

During volatile times, diversification and maintaining a long-term investment horizon represent your best options. Keep your money invested and ignore the noise. Our portfolios continue to have exposure to different sectors while generating dividend and interest income. As unexciting as it sounds, it’s proven to work over the long run.

Further Reading:

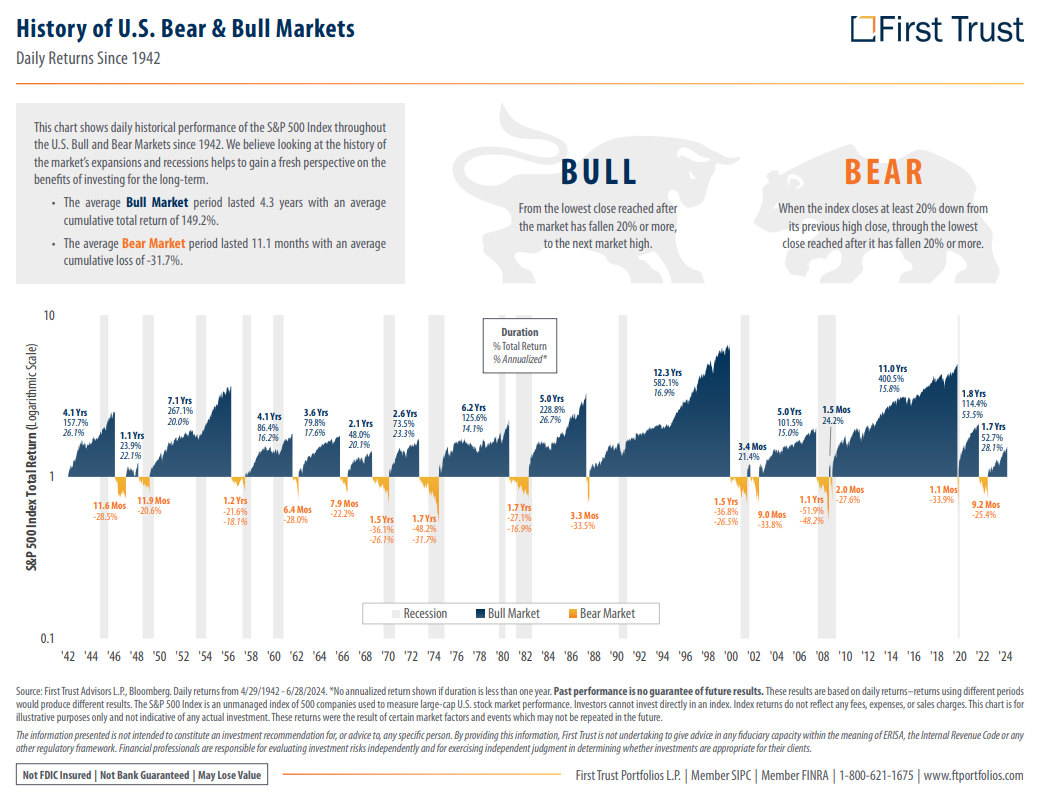

Bulls – when markets go up – and bears – when markets decline – are a natural part of the stock market cycle. There’s no use trying to time the markets; you’re just catching a falling knife. You may be right once in a while, but over the long term it pays to stay invested. Since 1942, the average bull market returned 149.2% and lasted a little over four years, while the average bear market retreated 31.7% and lasted a less than a year.

If you are interested in speaking with Ron Aloni and Jason Chen regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leede.ca.

Best Regards,

Ron Aloni / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Financial Inc. of any of the products, services or opinions of the corporation or organization or individual. Leede Financial Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Financial Inc. Leede Financial Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.