Dear Valued Client,

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

– Warren Buffett, chairman and CEO of Berkshire Hathaway.

Aloni Goh Wealth Strategy Notes:

Equity markets are in a mild short-term corrective phase so far. This phase could last for another couple of months with some added volatility. We expect the markets to form a nice base during this time, which would set the stage for a rally towards the end of the year.

We also expect the market to challenge and exceed all-time highs in due course. Hence, our basic strategy remains to be positioned for a long-term bull market and reinvest cash flows during the corrective phases such as the one we’re in right now.

Further Reading:

From Charles Schwab, an American multinational financial services company, established in 1971 in California and now ranks as one of the largest banks in the U.S. by assets.

What does it mean when a market is going through a correction?

A correction in the stock market is technically defined as a 10 percent drop from its most recent high. Markets have moved mostly sideways over the past few months and all major indices around the world are in positive territory except for the Hang Seng Index (Hong Kong) as of Sept. 1, 2023. The TSX is up around 6% and the Nasdaq continues its lead at roughly 34%. Despite the recovery, the TSX has not returned to its high in April 2022 and the Nasdaq to its high in November 2021. The rate of inflation has moderated and central banks around the world remain committed to high interest rates until they reach their inflation targets.

As per the report from Charles Schwab, corrections do not mark the start of a bear market. Historically, only five market corrections since 1974 have turned into bear markets.

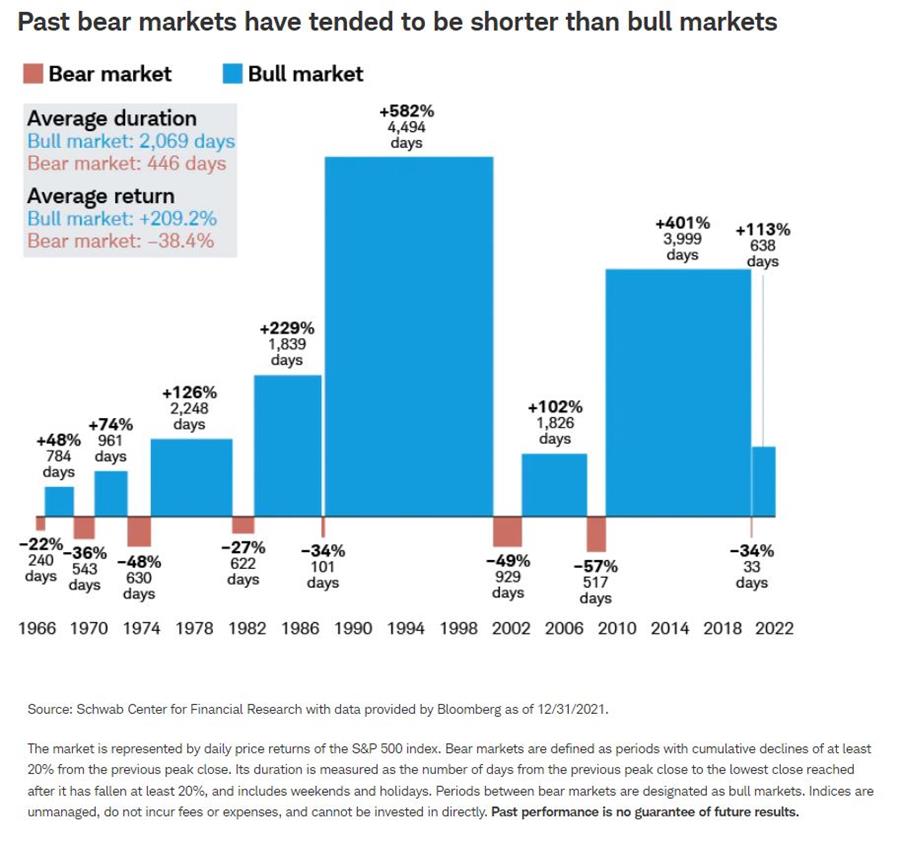

And even if corrections turn into bear markets, they tend to be much shorter than bull markets, which are on average five times longer than bear markets.

The message is simple: stay invested and ride out the corrections and bear markets. Aloni Goh Wealth Management’s portfolios are designed to be long-term investments. The bond and stock markets have seen price declines, and as we noted in our Strategy Notes, we believe the markets are forming a base and may exceed all-time highs in due course.

The four steps Charles Schwab encourages investors to plan for during periods like this — making a financial plan, reviewing your risk tolerance, rebalancing regularly and taking your life stage into consideration — are also the same four steps we use in crafting a financial plan for you.

Taking your life stage into consideration, we review your risk tolerance and your financial needs, craft a plan designed to meet your goals and take care to rebalance when necessary. This is part of the financial service and commitment to you at Aloni Goh Wealth Management.

As always, if you have any questions or wish to discuss whether any of the mentioned investments are suitable for you, please do not hesitate to call us at 604-658-3056 or email.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the IIROC and the Canadian Investor Protection Fund.