Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

They say January is the most depressing month of the year – we would contend it’s late April, when the Canucks bow out of the playoffs early, though we’re more hopeful than ever this season – but the markets certainly didn’t feel like it.

With the prospect of looming interest rate cuts by the Fed later this year – though not as early as March, as Jay Powell notes, briefly sending markets into a sell-off – and inflation ticking lower and lower to the Fed’s 2% target, markets are off to a bullish start.

Given the mounting geopolitical risks in the ongoing war in Ukraine and the conflict in the Middle East, and the upcoming U.S. election that looks like it will pit Trump against Biden once again in an unprecedented time of tension and division in the country, we continue to expect volatility going forward.

Markets have a tendency to climb a wall of worry – the periodic tendency to surmount a host of negative factors and keep ascending – and the path is rarely a straight line. Historically, markets have been resilient when they run into a temporary stumbling block.

We preach again, and will continue to do so in the coming months, to have patience and hold fast despite the potential market fluctuations.

Further Reading:

As a reminder, it’s time to make contributions to your registered accounts.

- Making your annual TFSA contributions. The contribution limit for 2024 is $7,000, an increase from $6,500 from last year.

- Making your RRSP contributions for the 2023 tax year. The amount you can contribute to your RRSP is based on your income last year less any pension adjustment up to a maximum of $30,780 for 2023. The deadline to do so is Thursday, February 29, 2024.

- If you are turning 71 years old this year, we will need to convert your RRSP to a RRIF by December 31, 2024.

- Annual outstanding minimum withdrawals from RRIF will need to be paid out by December 31, 2024.

- More information is reflected in the Resources section of our website under ‘FAQ’: https://alonigohwealth.com/resources/

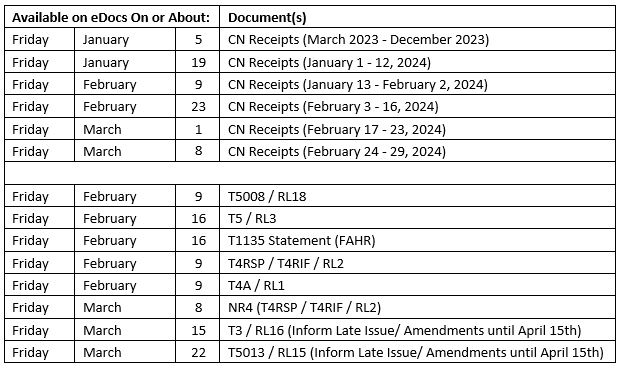

Below is a summary of the anticipated timeline for the distribution of the tax filing documents for the 2023 tax year. ‘CN Receipts’ are your RRSP contribution receipts.

As part of our on-going service, we can prepare and send your tax-related documents to you upon request.

If you would like us to forward your tax-related information directly to your accountant, please have your accountant email us.

We will also require a verbal confirmation from you before we forward any documents to your accountant per industry regulations.

If you are interested in speaking with Aloni Goh Wealth Management regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leedejonesgable.com.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.