Dear Valued Client,

Wealth Strategy Notes:

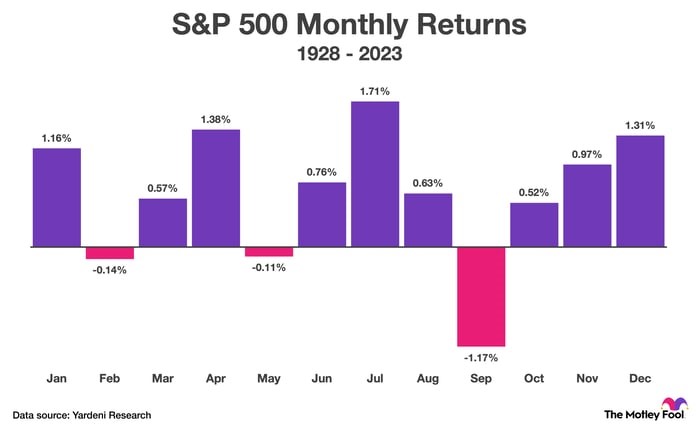

True to history as the most volatile month on the calendar, September is off to a rocky start. Just like parents and kids trying to get back into “school mode” following and the New York Giants trying to figure out how to actually play football, the markets are trying to figure out where to go from here.

On the positive side, markets have climbed to new highs in 2024 with some thanks to a slowing inflation rate, a stronger-than-expected economy and expectations that the Fed will start cutting interest rates on Sept. 18. Plenty of cash remains on the sidelines, ready to deploy and potentially push the markets higher when rates are cut and term deposits and other cash equivalents no longer look as attractive as they did a year ago.

Source: Bob Rich, Hedgeye

Yet the month opened with a historically poor first week, dropping more than 2.5 percent. Even good earnings couldn’t push the market further up; NVDA, the stock market’s darling this year, reported a July quarterly revenue that was up 122 percent year-over-year but saw its shares plummet six percent in part because it didn’t meet investors’ sky-high expectations. The hype was immense – it launched cringey watch parties – and the narrative has turned to the realization of expensive valuations in an overhyped AI market, sluggish manufacturing numbers, a Fed that may have decided to cut rates too late and the possibility of a harder-than-expected landing. It’s a fickle market, indeed.

To combat such volatility and uncertainty, we believe the best strategy is to remain invested. Staying invested means not trying to catch a falling knife, continuing to earn income and tax-efficient dividends and staying long. We’ve eschewed some of the most aggressive movers to reduce volatility yet continue to participate in the rising markets. In time, we believe markets can recover from market downturns and climb a wall of worry.

Source: Nasdaq.com

Further Reading:

In a report from J.P. Morgan Wealth Management, they dug into the current bifurcated stock market and note “boring is not bad.” We agree with this notion. While the markets had a tough first week of September, the report notes three of the 11 sectors in the S&P 500 finished higher: consumer staples, utilities and real estate. Further:

“Defensive stocks… tend to be less sensitive to the ebbs and flows of the economic cycle. This means they may have the ability to produce more durable cash flows and consistent revenues. Earnings estimates show the health care, industrial and consumer staples (to name just a handful) sectors growing into 2025… For investors that are feeling “big-tech fatigue,” looking across more defensive sectors could be compelling.”

If you are interested in speaking with Ron Aloni and Jason Chen regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leede.ca.

Best Regards,

Ron Aloni / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Financial Inc. of any of the products, services or opinions of the corporation or organization or individual. Leede Financial Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Financial Inc. Leede Financial Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.