Dear Valued Client,

Wealth Strategy Notes:

Global markets saw red following the unveiling of President Trump’s new tariffs last week, which were much more aggressive than anticipated. The announcement caught global markets off-guard with all major indices falling in real-time during the announcement.

It was not surprising to see the Trump administration impose tariffs on countries they believe have benefitted unfairly from the U.S., but the degree of the tariffs and the promise of slapping on additional reciprocal tariffs certainly was. Click here to see the full list of tariffs by country.

Markets continued to soften as the true impact of a potential tariff war has yet to play out. We know why the Trump administration is doing this – it’s true that American exports have faced stiff tariffs over many years – and it’s no secret he’s also in favour of lower interest rates, which will in turn make the historically high U.S. debt easier to service. (Corporate tax cuts will likely come later).

While markets and media pundits invoke panic, we note this market downturn is not based on structural changes such as the Great Financial Crisis, when there were legitimate concerns the U.S. banking system would fail. What we’re witnessing reflects new trade and foreign policies aimed to disrupt the status quo and benefit the U.S. in the long run.

Further uncertainty stems from the various responses the American tariffs will induce. Some countries, such as Vietnam and Taiwan, may wipe out all tariffs on American goods. Other countries, such as China, have dug in with reciprocal tariffs and, without explicitly saying so, engaged in a tariff war. The EU has also promised a unified response. The Fed is treading carefully regarding interest rates with some concern inflation – tariffs tend to be inflationary – could pick up again.

We harken again back to our newsletter a few months ago that our portfolios and investment strategies are politically agnostic. Markets can go up regardless if the sitting president is a Democrat or Republican.

The volatility hitting the markets are not structural changes but policy changes. There are no banking failures, unemployment remains low, and companies and industries continue production. Policies can change, tariffs are negotiable, and administrations come and go.

Our Canadian dividend portfolios continue to earn tax-favourable dividends, and our shift to higher quality bonds over the past year has helped reduce volatility and preserve capital while continuing to pay yields well above the risk-free rates.

Further Reading:

In case you missed it, Ron appeared on Global News Vancouver to discuss investment strategies for long-term investors last Thursday.

Click here to watch Ron on the news: https://globalnews.ca/news/11114935/donald-trump-trade-war-retirement-concerns-markets-plummet-worldwide/

Ron’s comments reflect or long-standing investment strategies: understand your risk tolerance, understand why you’re invested in the assets you hold, and understand your long-term strategies. When investors feel nervous – don’t worry, it’s natural – it’s a good time to re-examine your risk tolerance.

We are always happy to speak with clients and new investors about how we can help them understand their portfolios and tolerance for risk.

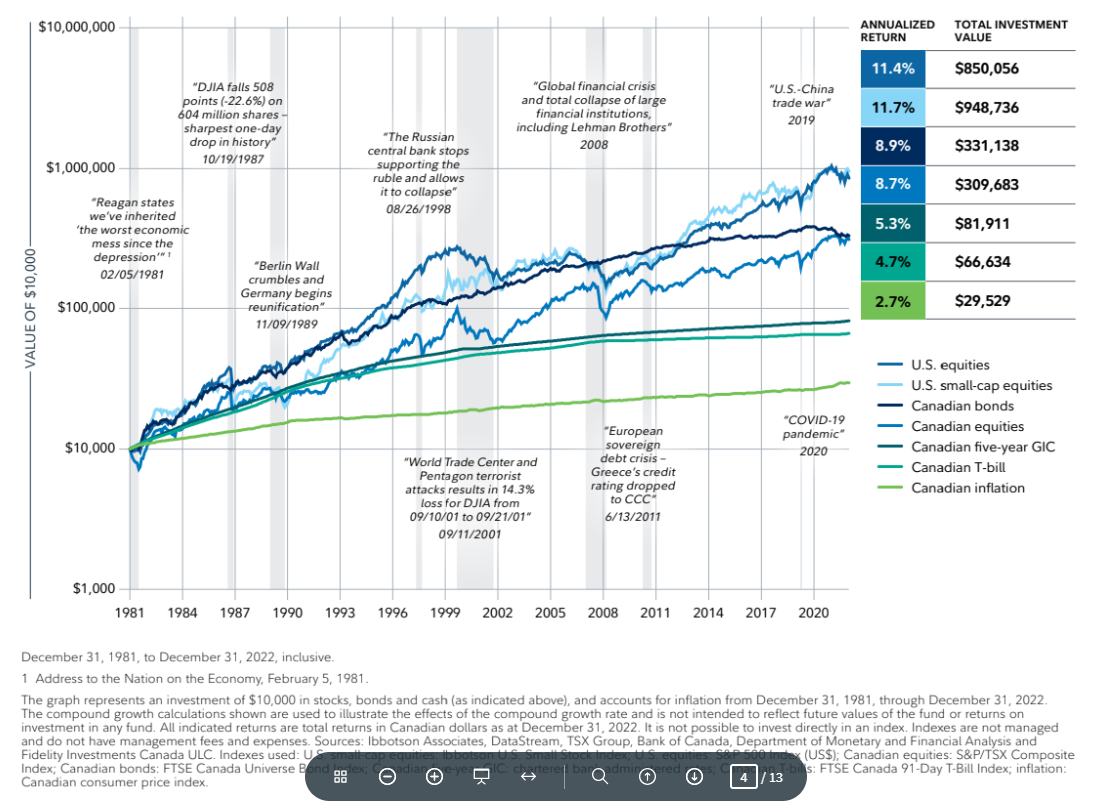

From our friends at Fidelity Investments, consider the chart below showing market performance since 1981 and how they’ve managed to bounce back from global events and crises:

If you are interested in speaking with Ron Aloni and Jason Chen regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leede.ca.

Best Regards,

Ron Aloni / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Financial Inc. of any of the products, services or opinions of the corporation or organization or individual. Leede Financial Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Financial Inc. Leede Financial Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.