Dear Valued Client,

Aloni Goh Wealth Strategy Notes:

Equity markets staged a rally this past month. At this point, a slight pullback would not be unexpected. The market has been forming what looks like a strong base at these levels, and the outlook is good for a possible challenge to all-time highs some time next year.

Our investments are centered around yield and long-term uptrends and the investment philosophy is to make reasonable returns whilst managing the associated risks. Aloni Goh Wealth Management exists to fulfill your investment goals of achieving reasonable returns given your risk parameters. Investment returns are rarely realized in a straight line; some years, you can’t squeeze out anything, and in other years, it’s easy. In the end, it’s about your objectives and your long-term rates of return.

Recent volatility has once again illustrated the need to stay focused on your investment objectives and to stick to with a long-term outlook.

Further Reading:

An important aspect of investing is yield. In its simplest terms, yield refers to the earnings generated and paid to you on an investment over a period of time. Yield is often expressed as an annual percentage based on the investment’s market value or purchase price.

There are different types of yield, such as dividend yield from an equity position, a measure of cash dividends paid out to its shareholders relative to its market value per share, and yield to maturity from a fixed income position, a measure of total return received when the bond is held to maturity.

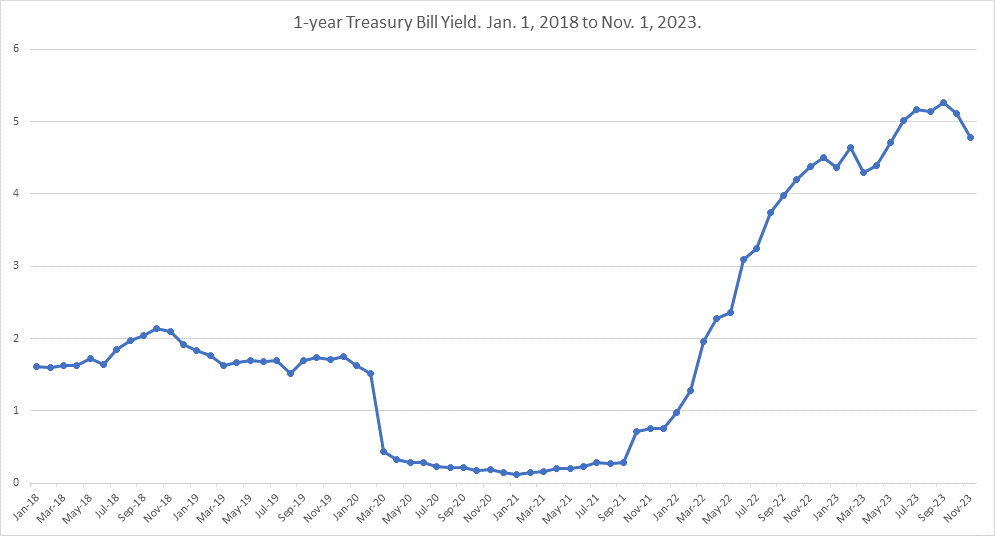

Our portfolios have generated over the long term, yields that are above the Bank of Canada’s 1-year treasury rates over the past 5 years and kept pace with the historic spike of interest rates. From Jan. 1, 2018 to Nov. 1, 2023, the average yield on a 1-year treasury bill is 1.98%. Since its lowest yield of 0.12% in January 2021 to its current yield of 4.78% as of Nov. 1, 2023, it has increased almost 4,000% during that period. The central banks have hiked rates in effort to reduce inflation after a long period of cheap money, and if your money was locked into a non-redeemable term deposit, such as a GIC, you were losing significant purchasing power during that time.

A survey of past rates, illustrated in the chart below, tells the following story: If you invested $100 in a 1-year Bank of Canada bond at the beginning of this year, the annual return would’ve been around 0.75%. For risk-free assets such as short-term GIC’s and short-term Government of Canada bonds, your average returns would be approximately 1.98% over the past 5 years. Only today are GIC’s yielding over 5% available to investors.

Aloni Goh Wealth Management’s portfolios are geared towards generating an appropriate level of yield based on a client’s risk objectives and financial goals. By buying individual positions rather than using a fund or a product managed by a third party, we can offer our portfolios at a lower cost while providing top-notch service and access to all markets. The Aloni Goh High-Yield Bond Portfolio, comprised of individual corporate bond positions, currently has a yield to maturity of approximately 7.42%.

If you know a family or a friend who can benefit from our investment services, please provide a referral. It is the best compliment you could ever give us.

Cheers to you and have a great holiday season.

Source: bankofcanada.ca/rates

If you are interested in speaking with Aloni Goh Wealth Management regarding your current financial situation, or perhaps know someone who we may assist, we would be pleased to help. Referral of friends and family is the greatest compliment you could give us.

Please visit us at alonigohwealth.com or contact call us by phone 604-658-3056 or email raloni@leedejonesgable.com.

Best Regards,

Ron Aloni / Alan Goh / Jason Chen

External links are provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Leede Jones Gable Inc of any of the products, services or opinions of the corporation or organization or individual. Leede Jones Gable Inc. bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links.

This commentary is intended for information purposes only and does not constitute an offer to buy or sell our products or services nor is it intended as investment and/or financial advice on any subject matter and is provided for your information only. Every effort has been made to ensure the accuracy of its contents. The views contained herein do not necessarily constitute the views of Leede Jones Gable Inc. Leede Jones Gable Inc. is licensed as an investment dealer in every Canadian Province and Territory and is a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.